What is Gift Aid and Historic Gift Aid?

April 2025

Gift Aid is a scheme created by the UK Government that allows charities to reclaim the tax already paid on donations from UK taxpayers. For every £1 donated, an extra 25p can be claimed by charities from the government, increasing the value of the donation at no extra cost to the donor.

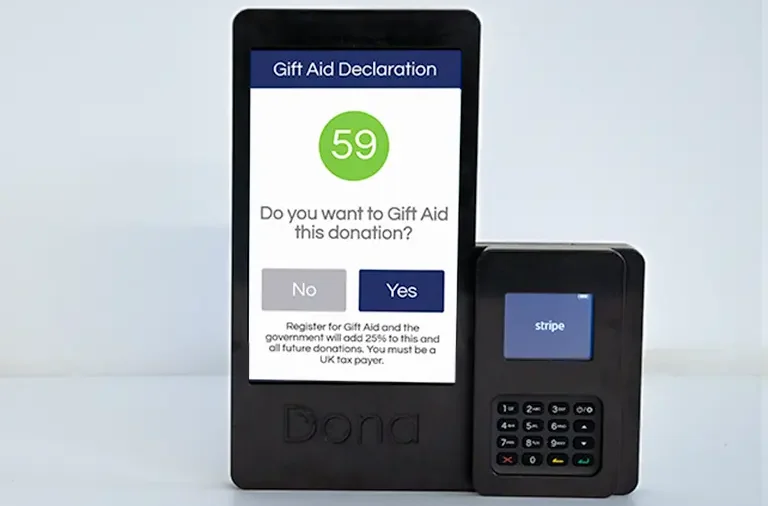

In order for their donations to be eligible for Gift Aid, donors must make a Gift Aid declaration, asserting that they are a UK taxpayer and that they wish for the charity to reclaim the tax back on their charitable contribution.

The UK government introduced Gift Aid back in 1990. At this time, there was a minimum donation limit of £600. The limit was removed in April 2000, making donations of any size eligible to be Gift Aided and meaning a big boost for smaller charities and community organisations.

In the tax year to April 2025, HMRC paid charities £1.7 billion in Gift Aid*, up 7% on the previous year.

How a Charity Benefits from Gift Aid

Charities can increase the value of donations from eligible UK taxpayers by 25%. This means that for every £1 donated, a charity can claim an extra 25p from HM Revenue & Customs (HMRC), making a £10 donation worth £12.50. This tax relief significantly boosts a charity’s income at no additional cost to the donor.

What a Charity Needs to Do to Claim Gift Aid

- HMRC Recognition: The charity must be recognised as a charity or registered as a Community Amateur Sports Club (CASC) with HMRC for tax purposes.

- Gift Aid Declarations: For each eligible donation, the charity must obtain a valid Gift Aid declaration from the donor. This declaration confirms that the donor is a UK taxpayer and has paid enough Income Tax or Capital Gains Tax to cover the Gift Aid amount the charity will claim on their donation. Declarations can be written, online, or verbal. When you fundraise with Dona, we supply you with HMRC-ready reports, so you can complete your Gift Aid declarations more easily.

- Register for Charities Online: Charities need to register for HMRC’s Charities Online service to submit their Gift Aid claims electronically.

- Compile Donation Records: Meticulous record-keeping is essential. Charities must compile details of all eligible donations, including donor names, addresses, and the amounts donated. The Dona management portal streamlines this process for registered charities by generating the HMRC reports ready for the Gift Aid application, simplifying the administrative burden and ensuring charities can efficiently claim the tax relief they are entitled to.

- Submit Claims: Claims are made online via the Charities Online service, typically using a spreadsheet of donations. Dona organisations are able to download HMRC-friendly reports, in a spreadsheet format that is quick and easy to submit to Charities Online.

How Donors Benefit from Gift Aid

For basic rate (20%) taxpayers, the direct financial benefit of Gift Aid goes to the charity, not the donor. However, donors have the satisfaction of knowing that their donation is amplified, allowing the charity to receive an additional 25% at no extra cost to them.

Higher-rate (40%) or additional-rate (45%) taxpayers can personally benefit by claiming back the difference between the higher rate of tax they pay and the basic rate (20%) that the charity claims. For example, if a higher-rate taxpayer donates £100 (which becomes £125 for the charity with Gift Aid), they can claim back £25 (£125 x 20%) via their Self-Assessment tax return, effectively reducing their own tax liability or increasing their overall donation to the charity.

How to claim Gift Aid as a donor

Donors just need to make a Gift Aid declaration to the charity when they donate. By signing or ticking a box, they confirm that they are a UK taxpayer and have paid enough tax to cover the Gift Aid that the charity will reclaim on their donation.

If a donor is a higher-rate or additional-rate taxpayer and wishes to claim the additional tax relief for themselves, they can do so in one of two ways:

- Self-Assessment Tax Return: By including their Gift Aid donations in the appropriate section of their annual Self-Assessment tax return.

- Contact HMRC: If they do not complete a Self-Assessment return, they can contact HMRC directly to inform them about their charitable donations, and HMRC may adjust their tax code.

What happens if someone completes the declaration that they shouldn’t have?

It is the responsibility of each individual donor to read the Gift Aid Terms and Conditions and only complete the declaration if this is applicable for them.

If the donor wants to change or cancel their declaration, they receive an email reminding them to contact the organisation they registered with after every Gift Aid donation they make.

Each time a donor donates through a Dona terminal or online webpage with Gift Aid, they will receive an automated email from Dona Donations to confirm that they have donated to that particular charity, with a reminder to update their preferences if Gift Aid details need to be changed.

Historic Gift Aid

Historic Gift Aid refers to the process of claiming Gift Aid retrospectively for donations made in previous tax years. Charities in the UK can claim Gift Aid on eligible donations made by UK taxpayers for up to four years prior to the end of the current accounting period. This allows charities to maximise the value of past donations, provided that a valid Gift Aid declaration is in place and the donor has paid sufficient tax to cover the claim.

- Historic Gift Aid allows charities to claim Gift Aid retrospectively for past donations.

- Charities can claim Gift Aid for eligible donations made up to four years prior.

- Donors must be UK taxpayers and have paid enough tax to cover the claim.

- The donor completes a Gift Aid declaration, allowing the charity to reclaim tax.

- Dona makes it easy for charities to collect Historic Gift Aid through the Dona management portal.

- Dona’s Gift Aid feature now includes Historic Gift Aid by default for new organisations.

Dona Gift Aid milestones

- Between the launch of Dona in 2020 and July 2025, a total of 1,118,743 donations has been Gift Aided through the Dona system with a value of £18,916,484.

- This means that as of July 2025, over £4,700,000 has been claimed in Gift Aid through Dona.

- £5.5 million has been donated to Gift Aid eligible categories but not Gift Aided – about £1.4 million in Gift Aid lost! This shows there needs to be more education for donors and charitable organisations about the Gift Aid opportunity.

- Dona has over 291,000 registered GA donors, from the 1.2 million donors who have used Dona.

- The ability to turn Gift Aid on or off for each donation terminal is essential, as it isn’t always more profitable for a charity to collect the registration from donors. This is particularly true when at a busy event, where allowing donors to register would cause queues, which could be offputting for some donors, who might not wish to wait to make their donation.

- On average, 41% of donations are given with Gift Aid across the Dona platform.

Dona offers award winning donation technology and continues to innovate and adapt our hardware and software to be the most efficient and productive at collecting donations and boosting organisations fundraising efforts.

Find out more about Dona’s donation machines, management portal and new AI-driven virtual fundraising assistant.

If you would like to contact us – Please choose your preferred method below or tap our live chat on the bottom right …